What is Tariff Staging?

7 minute read

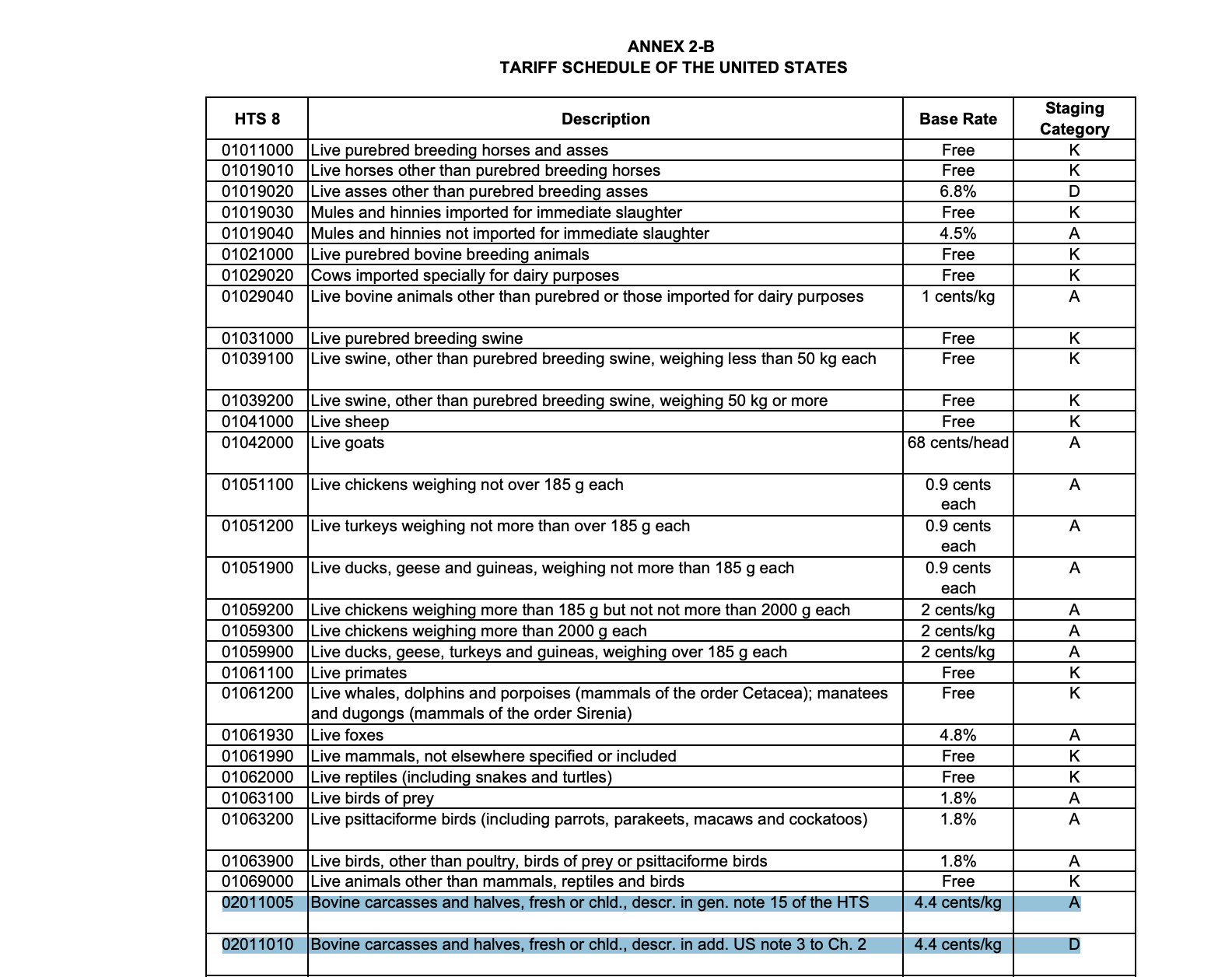

There are about 373 free trade agreements (FTAs) currently in force according to the WTO.1 Common among all agreements is the tariff schedule that details every product codes and how tariffs are to be eliminated. For example, take a look at the US’s tariff schedule toward South Korean imports from the US-Korea FTA (i.e., KORUS). Here, there are four columns:

HTS 8: lists the 8-digit product codes that are specific to the US (the first 6 are internationally harmonized).

Description: provides, well, the description of the specific product code.

Base Rate: lists the most-favored-nation (MFN) rate for each product at the time of negotiation.2

Staging Category: lists the staging category for each product.

Immediately, any reader would be confused about what any of the “staging category” actually means. Why does “bovine carcasses and halves fresh or chilled” product have two separate staging categories? Why do we even have two separate HTS codes to describe the same traded good? What is the difference between A and D staging?

| HTS8 | Description | Base Rate | Staging Category |

|---|---|---|---|

| 02011005 | Bovine carcasses and halves, fresh or chld., descr. in gen. note 15 of the HTS | 4.4 cents/kg | A |

| 02011010 | Bovine carcasses and halves, fresh or chld., descr. in add. US note 3 to Ch. 2 | 4.4 cents/kg | D |

Let’s answer these questions backward. First, in order to understand the stagings, we need to take a look at the “Tariff Elimination” Annex 2-B under the “National Treatment and Market Access for Goods” chapter.

duties on originating goods provided for in the items in staging category A in a Party’s Schedule shall be eliminated entirely and such goods shall be duty-free on the date this Agreement enters into force;

duties on originating goods provided for in the items in staging category D in a Party’s Schedule shall be removed in five equal annual stages beginning on the date this Agreement enters into force, and such goods shall be duty-free, effective January 1 of year five;

What Annex 2-B tells us is that imports of bovine carcasses and halves that fit the description in the general note 15 of the HTS (02011005) would enter duty-free as soon as KORUS enters into force. On the other hands, bovine carcasses and halves that fit the description in US note 3 to HTS Chapter 2 (02011010) would be phased out over five years in equal annual stages.

OK, now that we have figured out what each of the staging categories means, let’s dive into what makes these two product codes different. For 02011005, the general note defines the import of bovine carcasses and halves not to be counted against the quantity of the tariff-rate quota if it is imported for non-commercial use.3 On the other hand, 02011010 specifies the maximum amount of bovine carcasses and halves in metric tons allowed to be entered into the US (presumably for commercial use). The note also includes a table of the quantities allowance for specific trade partners.

| Country | Quantity (metric ton) |

|---|---|

| Canada | No limit |

| Mexico | No limit |

| Australia | 378,214 |

| New Zealand | 213,402 |

| Argentina | 20,000 |

| Uruguay | 20,000 |

| Other countries or area | 65,005 |

Hence, the interpretation of 02011010’s tariff treatment is that the duty portion of the tariff-rate quota (4.4 cents/kg) would be phased out over 5 years, but there would remain the maximum 65,005 metric tons quota on Korean bovine carcasses and halves. The tariff on the two bovine variants would look something like this:

| HTS | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| 02011005 | 0 cent/kg | ||||

| 02011010 | 3.52 cents/kg | 2.64 cents/kg | 1.76 cents/kg | 0.88 cents/kg | 0 cent/kg |

Side note: not every free trade agreement uses tariff staging categories. Instead, they would clearly specify the tariffs for each year like the table above.

What implication does tariff phaseout have on the tariff revenue from importing 65,005 metric tons worth of bovine carcasses each year after KORUS enters into force versus before? The table below calculates the dollar amount that would be collected by customs.

| Year | Tariff Revenue4 from 02011010 |

|---|---|

| Year 0 | $2,860,220. |

| Year 1 | $2,288,176 |

| Year 2 | $1,716,132 |

| Year 3 | $1,144,088 |

| Year 4 | $572,044 |

| Year 5 | 0 |

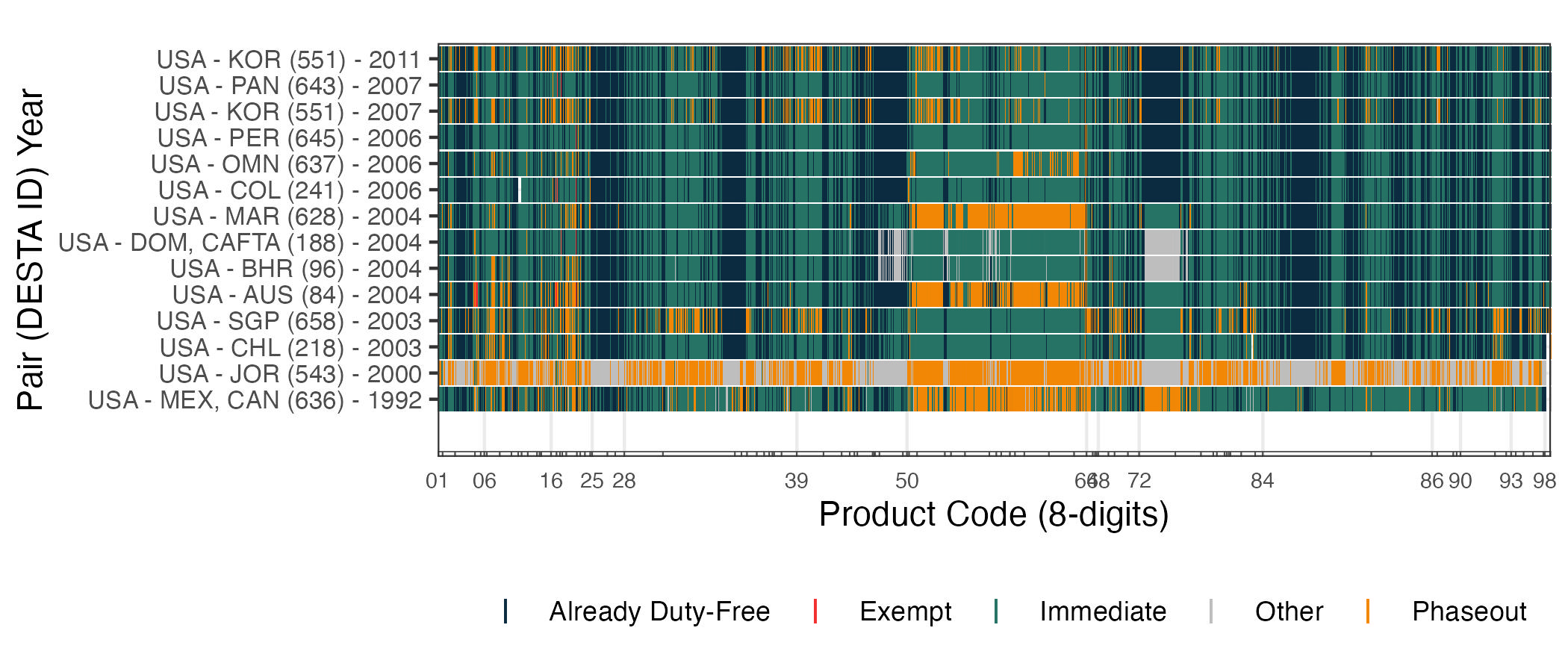

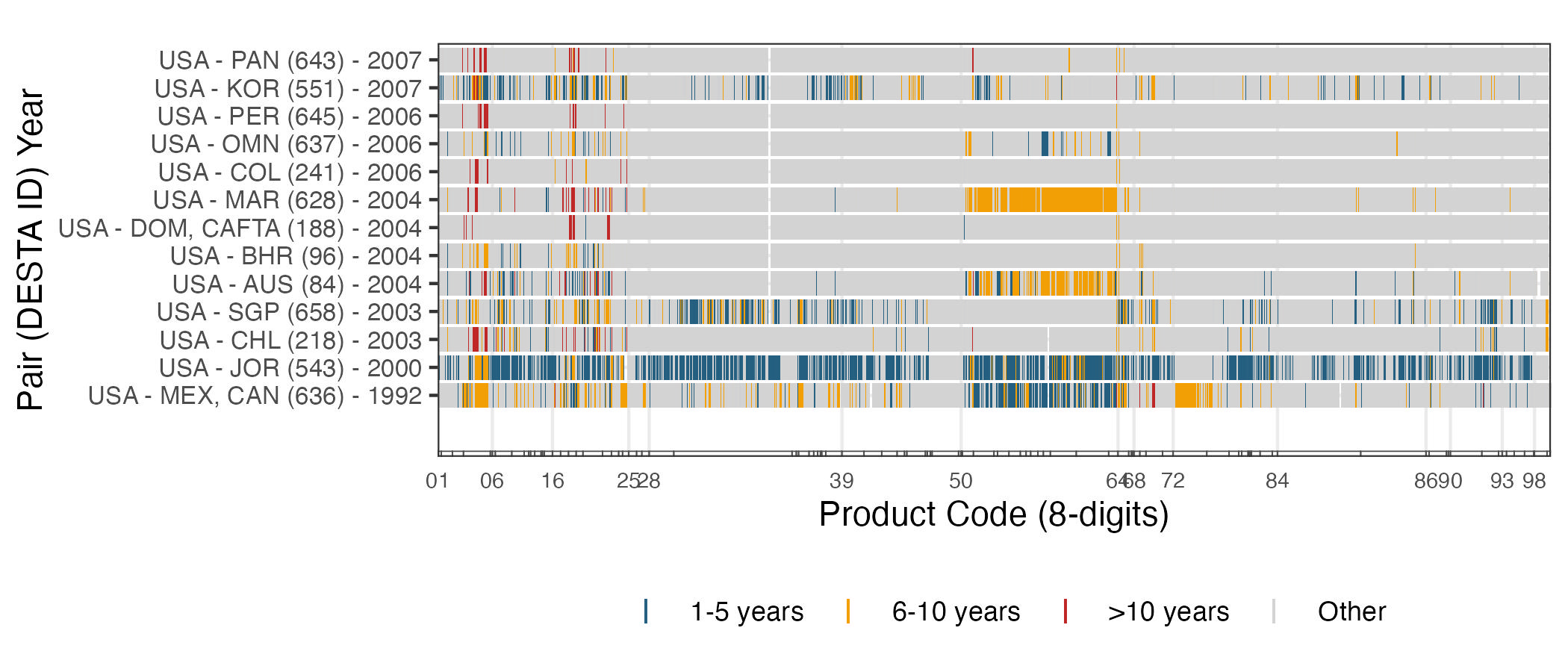

Concluding Note: This is just a technical introduction to the complicated but super fascinating world of tariff staging. While I only provided an example on the treatment of bovine carcasses imports from South Korea, the figures below illustrates the wide variety of tariff treatment and diversity of phaseout durations across all products with all US trade partners. Future blog posts will touch on why tariff staging is economically and politically relevant and what policymakers and academics can learn from tariff phaseouts.

Interested in what explains the variation in tariff phaseouts? My job market paper demonstrates that the structure of US FTA tariff schedules can be explained not just by economic factors but also by the executives’ interests in insulating themselves electorally.

Free trade agreements are also known as “regional” trade agreements (RTAs). RTAs have proliferated seven-folds since the WTO Uruguay Round concluded in 1995. The WTO reports that there are about 373 regional trade agreements currently in force (whereas only 45 in 1995), although the number of “preferential” trade agreement has gone beyond 730 (Dür et al. 2014).

Preferential trade agreements or “PTAs” are often used in the trade agreement literature and they broadly describe any preferential arrangement on trade between two or more countries. PTAs include (1) limited scope agreements, which liberalize only a small number of sectors and sometimes do not fully eliminate trade barriers for those sectors (e.g., US-Japan trade agreement); (2) services agreements, which liberalize barriers to trade on services, not on goods (e.g., ASEAN Trade in Services Agreement (ATISA); (3) customs unions, which eliminate trade barriers and establish a common external tariff system (e.g., EU, MERCOSUR); and (4) free trade agreements (FTAs), which eliminate substantially all trade barriers (e.g., NAFTA, KORUS).

In terms of trade in goods, only customs unions and FTAs are authorized by/compliant with the WTO (See GATT Article XXIV), hence the smaller number in RTAs reported by the WTO. On the other hand, services agreements are authorized under (GATS Article V). ↩

The US’s version of MFN rates is called normal trading relations (NTR) rates. ↩

For example, the rule applies if the product imported by or for the account for any US agency (a); imported for personal use, provided that it does not exceed 5 kilograms (b); or it is imported not for commercial purposes, but “as samples for taking orders, for exhibition, display or sampling at a trade fair, for research, for use by embassies of foreign governments or for testing of equipment, provided that written approval of the Secretary of Agriculture or his designated representative the United States Department of Agriculture (USDA) is presented at the time of entry” (c) (General Note 15). ↩

1 metric ton = 1000 kg. Hence, 65,005 metric tons = 65005000 kg. ↩